FY2023 Budget Summary

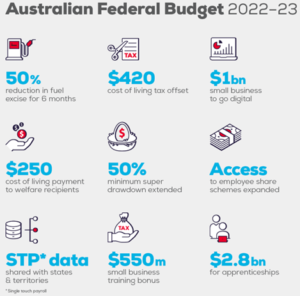

Included below is a snapshot of the major changes announced in the 2022-23 Federal Budget. For the 6 key features that are likely to impact you and your business, please read on. If you require any further clarification or advice on how these changes apply directly to you, please do not hesitate to contact us.

- Fuel excise reduction

For the six-month period ending 28 September 2022, the current 44.2 cents per litre fuel excise charged to suppliers is proposed to be reduced to 22.1 cents per litre. This is under the expectation that the savings will be passed on to consumers and thereby reduce business and household fuel costs. This measure will be monitored by the Australian Competition and Consumer Commission (ACCC). Finally, we note that the proposed cut will apply to petroleum-based products with the exception of aviation fuels.

- 120% Deduction – Digital technology

Businesses with aggregated turnovers below $50 million can expect to receive a new temporary deduction for certain digital technology costs incurred between 29 March 2022 and 30 June 2023. These costs include cyber security systems, portable payment devices and cloud-based services. Further details will follow in due course. The deduction is proposed at 120% of the cost incurred. An annual cap of $100,000 will apply in each of the applicable financial years.

We also note that the temporary full expensing measure announced last year has now been extended to 30 June 2023.

- 120% Deduction – Employee Training

Businesses with aggregated turnovers below $50 million can also expect to receive a new temporary deduction for the training and upskilling of employees. This proposed measure will apply from 29 March 2022 to 30 June 2024. Expenditure incurred in the 2022 financial year will be claimed in the 2023 income tax return but expenditures incurred in the 2023 and 2024 financial years will be claimable in the tax returns of those respective years. The deduction will be 120% of costs incurred for training conducted by entities registered in Australia. Exclusions will apply to some on the job training and training provided to non-employees.

- Low- and Middle-Income Tax Offset

For the year ending 30 June 2022, the low- and middle-income tax offset is expected to increase based on the following thresholds –

| Tax bracket | Legislated rate for 2021–22 | Proposed rate for 2021–22 |

| $0–$37,000 | $255 | $675 ($255 + $420) |

| $37,001–$48,000 | $255 plus 7.5% of the amount of the income that exceeds $37,000 | $675 ($255 + $420) plus 7.5% of the amount of the income that exceeds $37,000 |

| $48,001–$90,000 | $1,080 | $1,500 ($1,080 + $420) |

| $90,001–$126,000 | $1,080 less 3% of the amount of the income that exceeds $90,000 | $1,500 ($1,080 + $420) less 3% of the amount of the income that exceeds $90,000 |

| $126,001 and over | $0 | $0 |

- PAYG Instalment Changes

The GDP uplift factor for PAYG Instalments currently sits at 10%. In the budget, the government is proposing a reduction to 2% for the 2023 financial year. Businesses with up to $50 million aggregated turnover are due to be impacted by this change.

Additionally, some corporate entities will also be allowed to calculate their PAYG instalments based on current (rather than historical) financial and tax results from 1 January 2024 onwards.

- Superannuation

The government previously announced a 50% reduction to the minimum pension drawdown rates for the 2020 to 2022 financial years. This reduction is now proposed to continue until 30 June 2023.

For completeness, we also note that, as expected the superannuation guarantee rate has now been legislated to become 10.5% commencing 1 July 2022.

Final points

There are a number of other business incentives which are rather niche. As a result, we have not commented on these. Still, we encourage you to contact us if you require our advice with regards to the budget and your specific circumstances.